신용도 지표 – 신용점수

개인의 신용도를 점수로 평가한 신용점수는 신용거래 시 이용한 금액, 기간, 연체 등을 종합하여 산정되는데 이전에는 신용등급으로 운영되었습니다.

높은 신용점수를 보유하고 있어야 신용카드 발급, 저금리 대출 등을 수월하게 받을 수 있으며 점수가 낮으면 금리가 높아지는 등 금융상품 이용에 있어서 어려움을 겪을 수 있습니다.

신용카드를 사용하지 않거나 대출을 받지 않으면 점수가 높을거라고 오해하는 경우가 있는데, 아주 낮지는 않지만 그렇다고 높지도 않은 중간에 위치하게 됩니다.

신용점수는 신용거래를 통해 산정되기 때문인데, 내역이 없으면 중간으로 정해지는 겁니다. 신용카드 및 대출을 이용하고 연체 없이 갚아서 채무상환 능력이 있다는 걸 보이면 점수가 올라가게 됩니다.

스스로 잘하고 있다 생각이 들어도 실제로 점수를 확인하지 않으면 높은지 낮은지 알 수가 없어서 관리하기가 쉽지 않은데, 무료로 확인할 수 있는 방법이 있습니다.

개인신용평가회사 올크레딧에서 서비스하고 있는 전국민 무료 신용점수 조회를 통해 본인의 점수가 잘 관리되고 있는지 확인해 보시기 바랍니다.

Table of Contents

무료 신용점수 조회방법

무료 신용점수 조회는 개인신용평가회사 나이스와 올크레딧을 통해 가능하며 1년에 총 3회, 분기별로 서비스가 제공되고 있습니다.

점수는 1점부터 1000점까지로 세분화되어 있고 회사에 따라 기준에 차이가 있는 편인데, 올크레딧이 나이스보다 높은 점수 받기가 어렵습니다.

| 등급 | 올크레딧 | 나이스 |

| 1 | 942~1000점 | 900~1000점 |

| 2 | 891~941점 | 870~899점 |

| 3 | 832~890점 | 840~869점 |

| 4 | 768~831점 | 805~839점 |

| 5 | 698~767점 | 750~804점 |

| 6 | 630~697점 | 665~749점 |

| 7 | 530~629점 | 600~664점 |

| 8 | 454~529점 | 515~599점 |

| 9 | 335~453점 | 445~514점 |

| 10 | 0~334점 | 0~444점 |

신용점수 조회방법은 나이스와 올크레딧이 비슷한데, 여기선 올크레딧을 이용해 보았습니다. 본인의 신용점수가 궁금하다면 방법 참고하여 확인해 보시기 바랍니다.

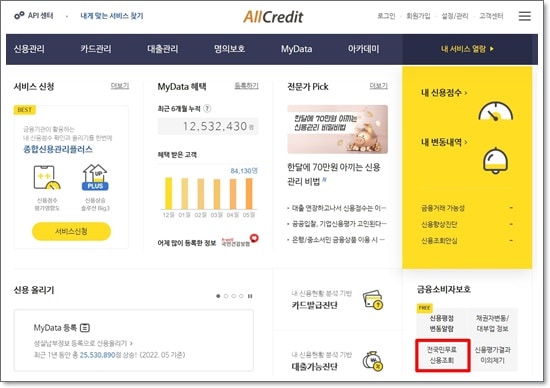

- 올크레딧>전국민무료신용조회

올크레딧 홈페이지 접속 후, 오른쪽 하단 금융소비자보호의 ‘전국민무료신용조회’를 클릭합니다. - 서비스 신청

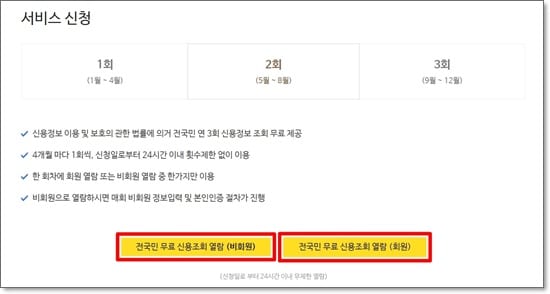

신청하는 분기와 안내사항을 확인하고 전국민 무료 신용조회 열람을 클릭합니다.신용점수 조회는 꾸준히 하는게 좋기 때문에 회원으로 진행하는 걸 추천합니다. - 로그인

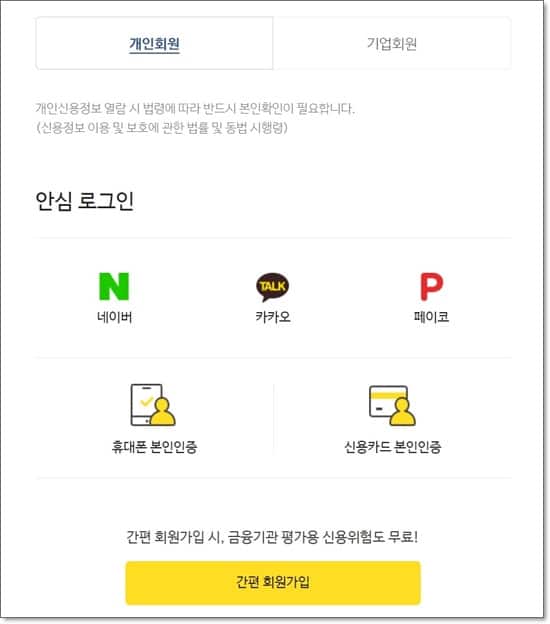

인증 방식을 선택, 로그인 합니다. - 신용조회 열람

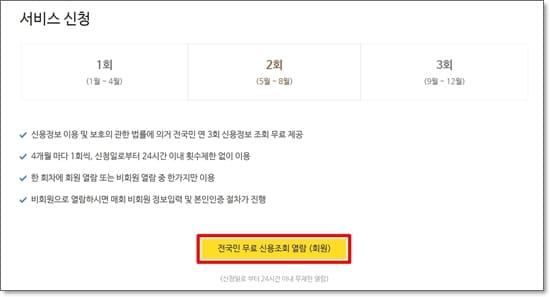

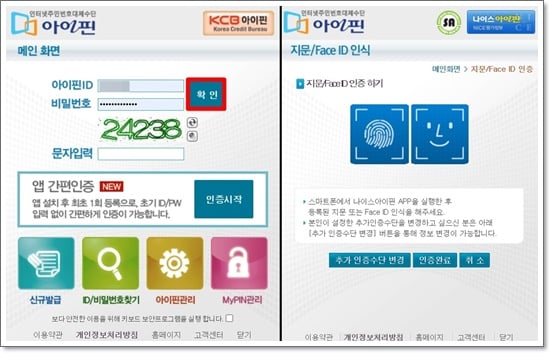

서비스 신청화면이 다시 나옵니다. ‘전국민 무료 신용조회 열람 (회원)’을 클릭합니다. - 아이핀 로그인

본인의 아이핀 ID와 비밀번호를 입력하고 추가 인증까지 완료합니다. - 신용평점 확인

인증이 모두 완료되면 개인 신용평점과 종합백분위를 확인할 수 있습니다. 이외에 대출 및 연체정보, 신용영향요인 등도 확인가능합니다.

신용점수 관리방법

신용점수를 관리하기 위해선 먼저 본인의 점수가 얼마인지 주기적으로 확인할 필요가 있습니다. 점수를 모르는 상태에서는 관리가 쉽지 않기 때문입니다.

분기별로 제공되는 신용점수 조회 서비스를 이용하면 불이익 없이 확인할 수 있으니 이를 잘 활용하는게 좋습니다.

제일 중요한건 연체로, 카드를 사용하거나 대출을 받은 후 대금 및 이자를 밀리지 않고 바로바로 내야 신용점수가 떨어지지 않습니다.

통신비도 마찬가지이니 자동이체를 설정해놓거나 매달 납부일을 잘확인하여 연체되지 않도록 관리하시기 바랍니다.